Azarga Metals Increases Inferred Resource For Unkur With Updated Mineral Resource Estimate

AZARGA METALS CORP. ("Azarga Metals" or the “Company”) (TSX-V:AZR) announces an updated Mineral Resource estimate for its Unkur Copper-Silver Project in the Zabaikalsky administrative region of eastern Russia. The estimate is an Inferred Mineral Resource of 62 million tonnes at 0.53% copper and 38.6g/t silver, containing 328,600 tonnes (724 million pounds) of copper and 76.8 million troy ounces of silver. This equates to copper equivalent grade of 0.90%, assuming a copper price of US$3.00/lb, silver price of US$20/oz and 100% recovery for copper and silver.

The updated Mineral Resource estimate represents an increase of approximately 20 million tonnes (ie, 47%) in the size of the Inferred Resource, compared to the Company’s maiden NI 43-101 Resource estimate (see the Company’s news release dated April 4, 2017), with both copper and silver grades having increased marginally. The increase in tonnage, as compared to the Company’s maiden Resource estimate, was caused by two factors. Firstly, as a result of a recent detailed review of the geology and style of mineralization of Unkur by Azarga Metals and Tetra Tech staff, a less restrictive approach has been deemed appropriate to the physical constraints applied to the three dimensional geological model of the deposit thereby including some mineralized zones that were previously excluded in the estimation of the maiden Resource. Secondly, the current work on the preliminary economic assessment (“PEA”) for Unkur has provided a more detailed understanding of the possible operating options for Unkur and associated costs, and Tetra Tech considers that there is a reasonable expectation of economic viability of some material that was excluded from the maiden Resource based on a hypothetical open-pit design. This material has now been included into the updated Mineral Resource estimate.

The updated Mineral Resource estimate was independently prepared by Tetra Tech Mining and Minerals (“Tetra Tech”), in accordance with National Instrument 43-101 (“NI 43-101”).

“We are encouraged by the results of this Mineral Resource update at Unkur”, said Dorian L. (Dusty) Nicol, the Company’s President and CEO. “This expanded Resource bodes well for the outcome of the ongoing PEA, which is on track for completion in the next two months. Significantly, much of the higher grade copper and silver mineralization is near-surface and we believe has a good likelihood for being considered open-pitable. The upcoming PEA will assess the mineralization potentially recoverable by open-pit methods. The mineralization remains open in multiple directions, and we therefore believe that the project has potential to grow significantly with additional exploration. This further validates our belief that Unkur has the potential to be a globally significant copper-silver deposit.”

A Technical Report covering the updated Mineral Resource estimate will be filed on SEDAR within 45 days of this news release. The Technical Report will be joint-authored by Tetra Tech and by SRK Consulting (Russia) Ltd. (“SRK”), who prepared the maiden NI 43-101 Resource estimate published in April 2017.

SUMMARY

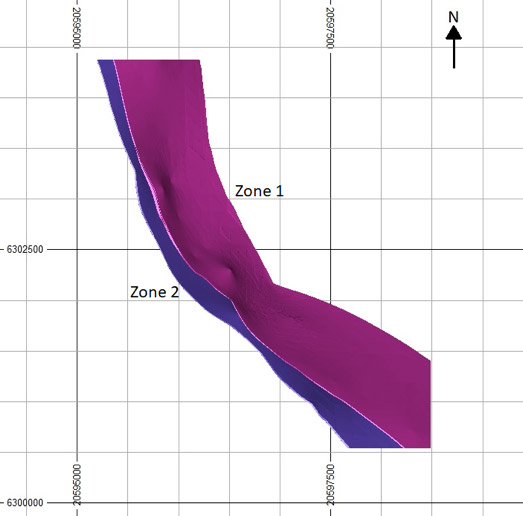

An Inferred Mineral Resource was estimated based on two geologically distinct structures, named Zone 1 and Zone 2. Zone 1 is the stratigraphically upper zone of mineralization and Zone 2 is the stratigraphically lower zone. The wireframes were built along strike beyond the influence of the data to assist with target generation, and the Resource was constrained by a hard boundary, informed by the search distance, post-estimation.

Resource Estimation Assumptions and Methods

Key Assumptions used to estimate the Mineral Resources are:

- The Mineral Resource has been estimated with dimensional block models of: 25m x 25m x 20m (x, y, z), with minimum sub-block dimensions of 5m x 5m x 10m (x, y, z).

- The estimate was constrained to the mineralised zone using wireframe solid models.

- Grade estimates were based on 1m composited assay data.

- The interpolation of the metal grades was undertaken using inverse distance weighting.

- In order to demonstrate that the deposit has reasonable prospects for economic extraction, a cut-off grade of 0.3% copper equivalent has been applied for Resources.

- The copper equivalency formula is Cu Eqv. =((Cu % × US$3.00 × 22.04) + (Ag g/t × US$20 × 0.0321)) ÷ US$3.00 ÷ 22.04:

- Cu price US$3.00/lb

- Cu recovery 100%.

- Ag price US$20/oz.

- Ag recovery 100%.

The revised Unkur Mineral Resource is presented in Table 1.

Table 1: Resource Statement for Unkur at 0.3% Cu equivalent cut-off grade

|

Class |

Tonnes |

Density |

Copper grade (%) |

Silver grade (g/t) |

Copper equivalent grade (%) |

Copper metal (t)*1 |

Silver metal (ozt) |

|---|---|---|---|---|---|---|---|

|

Inferred |

62,000,000 |

2.67 |

0.53 |

38.60 |

0.90 |

328,600 |

76,881,000 |

Notes: The effective date of the Resources is March 16 2018. Mineral Resources that are not mineral Reserves do not have demonstrated economic viability. The estimate of mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. Numbers may not sum due to rounding.

*1 328,600t Cu = 724,234,400lbs

GROWTH POTENTIAL

Azarga Metals considers that there is strong potential to grow the Mineral Resource at the Unkur Copper-Silver Project beyond that identified in this Mineral Resource estimate. The mineralization is open in both directions along strike and further exploration drilling will aim to extend mineralization along strike. Of key interest for growth potential is the zone of thicker and higher grade mineralization in the northern part of the interpreted Mineralised area.

The next phase of work will focus on using geologic and geophysical exploration to target potential extensions of this higher grade zone. The mineralization also remains open down-dip. In addition to this Unkur Copper-Silver Project Inferred Mineral Resource area and its potential extensions, there are numerous additional occurrences of copper-silver mineralization and geochemical / geophysical anomalies within the Company’s 5,390 hectare Unkur License.

DETAILS OF MINERAL RESOURCE ESTIMATE DATED 16 MARCH 2018

Details of Mineral Resource estimate dated 16 March 2018

The updated Mineral Resource estimate update was prepared by Tetra Tech, under the direction of Mr. Joe Hirst B.Sc., M.Sc. EurGeol (European Geologist) CGeol (Chartered Geologist) . Mr. Hirst is a Resource Geologist at Tetra Tech, and an independent Qualified Person as defined by NI 43-101. The results are reported in accordance with NI 43-101 and the 2014 CIM Definition Standards.

A site visit to the Unkur Copper-Silver Project and to SGS Laboaratories in Chita was performed during October 2016 by the Qualified Person for SRK, who prepared the maiden NI 43-101 Resource estimate, and who will co-author the Technical Report on the Resource estimate update.

Mr. Hirst has reviewed the technical and scientific information in this press release relating to the Mineral Resource estimates and has approved the use of the information contained herein.

Data verification

SRK’s Qualified Person has verified the database the Mineral Resource estimate is based on. This verification was done by personal inspection of drill core, drill sites and trenches during the site visit, and by checking database content against primary data sources and historical information.

Exploration Information

The estimate is based on 4,580 meters of diamond drilling (from 16 drill-holes) and 186 meters of channel sampling (from four trenches), completed during Azarga Metals’ first exploration campaign from August 2016 until February 2017.

In the opinion of the Qualified Person for SRK, the core and channel samples collected by Azarga Metals are sufficiently accurate and reliable for use in Mineral Resource estimation, and there are no material data quality issues related to drilling, sampling, recovery or other factors.

Intervals identified by Azarga Metals’ geologists as potentially mineralized were sampled, typically on one meter lengths. The half-core samples from drill core, and channel samples from trenches, were sent to SGS Laboratories in Chita for analysis of copper and silver. Standard QA/QC protocols were followed, including analysis of duplicates and standards and check analyses by ALS Laboratories in Chita. The results of this QA/QC checking will be presented in the forthcoming Technical Report.

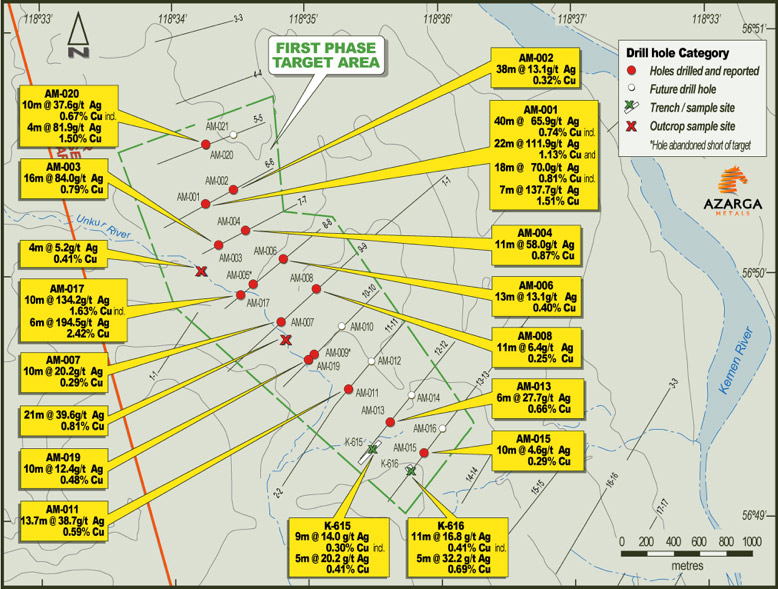

The main identified zone of copper-silver mineralization (Zone 1) is intersected by 13 drill-holes and two trenches. Drill-hole collar and trench locations are tabulated in Table 2 and the mineralized intersections are summarized in Table 3. The locations of these intersections are shown in Figure 1.

Table 2: Drill-hole collar and trench locations from August 2016 to February 2017 physical exploration program at Unkur Copper-Silver Project

|

Hole or trench ID |

X |

Y |

Z (RL m) |

Maximum depth (m) |

Starting dip (deg) |

Starting azimuth (deg) |

|---|---|---|---|---|---|---|

|

AM-020 |

20595906 |

6303578 |

902.7 |

284.9 |

-70 |

249 |

|

AM-001 |

20595871 |

6303108 |

929.7 |

400.5 |

-69 |

241 |

|

AM-002 |

20596077 |

6303227 |

919.4 |

520.5 |

-70 |

248 |

|

AM-003 |

20595911 |

6302753 |

930.5 |

100.0 |

-72 |

242 |

|

AM-004 |

20596093 |

6302871 |

935.5 |

382.9 |

-70 |

242 |

|

AM-005 |

20596247 |

6302510 |

913.7 |

160.0 |

-71 |

241 |

|

AM-006 |

20596388 |

6302620 |

955.1 |

572.0 |

-69 |

221 |

|

AM-007 |

20596411 |

6302155 |

927.7 |

80.0 |

-70 |

222 |

|

AM-008 |

20596611 |

6302365 |

1,007.8 |

601.3 |

-72 |

228 |

|

AM-009 |

20596725 |

6301968 |

983.0 |

238.0 |

-69 |

224 |

|

AM-011 |

20596936 |

6301672 |

952.3 |

178.5 |

-68 |

223 |

|

AM-013 |

20597233 |

6301394 |

995.8 |

100.0 |

-68 |

220 |

|

AM-015 |

20597567 |

6301246 |

1042.0 |

201.0 |

-68 |

217 |

|

AM-017 |

20596211 |

6302467 |

916.1 |

277.5 |

-71 |

230 |

|

AM-019 |

20596639 |

6301879 |

938.9 |

226.7 |

-69 |

224 |

|

AM-018 |

20595635 |

6302977 |

937.8 |

256.6 |

-73 |

241 |

|

TR K601 |

20596492 |

6301887 |

969.1 |

14.0 |

0 |

236 |

|

TR K615 |

20597213 |

6301311 |

1,015.4 |

115.0 |

0 |

222 |

|

TR K616 |

20597472 |

6301143 |

1,049.5 |

29.0 |

0 |

233 |

Table 3: Intersections used for estimation(1)

|

Hole or trench ID |

From (m) |

To |

Length (m) |

Copper grade (%) |

Silver grade (%) |

Copper equivalent grade (%) |

True thickness (m) |

|---|---|---|---|---|---|---|---|

|

Zone 1 |

|||||||

|

AM-020 |

227.0 |

241.0 |

14 |

0.51 |

28.44 |

0.79 |

10.6 |

|

AM-001(2) |

82.5 |

125.5 |

33 |

0.83 |

79.81 |

1.61 |

20.1 |

|

AM-002 |

432.5 |

472.5 |

40 |

0.31 |

12.77 |

0.44 |

33.8 |

|

AM-003(3) |

40.5 |

77.5 |

37 |

0.43 |

39.63 |

0.82 |

26.9 |

|

AM-004(4) |

319.5 |

358.5 |

31 |

0.44 |

27.23 |

0.70 |

23.7 |

|

AM-006 |

440.5 |

456.5 |

16 |

0.34 |

11.02 |

0.45 |

14.4 |

|

AM-007 |

47.0 |

60.0 |

13 |

0.25 |

17.12 |

0.41 |

10.9 |

|

AM-008 |

352.3 |

364.3 |

12 |

0.24 |

6.02 |

0.30 |

9.9 |

|

AM-011 |

145.5 |

153.9 |

8.4 |

0.92 |

61.73 |

1.52 |

7.3 |

|

AM-013 |

70.0 |

78.0 |

8 |

0.53 |

22.62 |

0.75 |

6.8 |

|

AM-015 |

135.0 |

145.0 |

10 |

0.29 |

4.55 |

0.34 |

8.7 |

|

AM-017 |

189.5 |

202.5 |

13 |

1.28 |

103.91 |

2.29 |

9.8 |

|

AM-019 |

39.0 |

49.0 |

10 |

0.48 |

12.39 |

0.60 |

8.6 |

|

TR K615 |

8.0 |

17.0 |

9 |

0.30 |

14.03 |

0.44 |

6.9 |

|

TR K616 |

18.0 |

29.0 |

11 |

0.41 |

6.32 |

0.47 |

8.1 |

|

Zone 2 (N) |

|||||||

|---|---|---|---|---|---|---|---|

|

AM-001 |

311.5 |

346.5 |

35 |

0.47 |

43.49 |

0.89 |

|

|

AM-019 |

106.0 |

119.0 |

13 |

0.17 |

4.99 |

0.22 |

|

Zone 2 (S) |

|||||||

|---|---|---|---|---|---|---|---|

|

TR K601 |

0.0 |

10.0 |

10 |

0.73 |

2.07 |

0.75 |

Notes: (1) copper and silver equivalent grades were estimated using US$3.00/lb copper price, US$20.00/oz silver price and 100% recovery using the formulae Cu eq = Cu + (0.009722 x Ag) and Ag eq = Ag + (102.86 x Cu); (2) mineralization begins at base of moraine, possibly intersection has been truncated by glacial erosion – composite excludes barren zone from 104.5 to 114.5; (3) mineralization begins at base of moraine, possibly intersection has been truncated by glacial erosion; and (4) composite excludes barren zone from 335.5 to 343.5.

Figure 1: Summary of intersections

Section lines for drilling are spaced approximately 300m apart. Where there are two Zone 1 intersections on the same drill section, the spacing between intersections is typically 200m to 300m.

Estimation methodology and parameters

A wireframe interpretation of the mineralized zones was constructed at a variable threshold of approximately 0.10% copper equivalent based on a rolling average grade threshold. Based on the limits of the current sampling coverage, the resultant Inferred mineralisation has been constrained to a strike length of 2.6 kilometers northwest-southeast, and a maximum down dip extent of up to 530 meters below surface. It is considered that the mineralised zones are open down dip and along strike in both directions. The Zones generally dip 50 to 60 degree to the east or northeast, and have an average true thickness of 19 meters.

Figure 2: Wireframe Interpretation

Source: Tetra Tech.

Scale: Major grid interval 2,500m.

The Lower Proterozoic sedimentary rocks that host mineralization are partly covered by Quaternary moraine. The thickness of the moraine cover over the northern part of the mineralization is up to 100 meters. The moraine cover lessens to the south, and mineralization in the south can be exposed by trenching.

Topography was modelled based on drill collar locations, and using additional elevation information digitized from topographic maps.

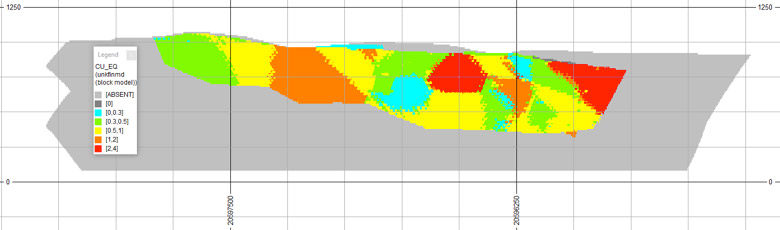

Copper and silver grades within the mineralized domain were estimated by Inverse Distance Weighting using 1m composite samples. Grade capping was applied to the composites at 2% Cu and 80g/t Ag as a low number of high grade samples are over represented in the generally small dataset. The parent cell size was 25 meters in the X and Y dimensions and 20 meters vertically, with subcelling to a minimum of 5 x 5 x 10m. The grade was estimated into the parent cell, with 3 points of descritisation in each dimension.

Figure 3: Isometric View of Cu Eqv. Grade distribution (looking sw)

Source: Tetra Tech. Absent values represent wireframe volume. Estimate constrained by search.

Scale: Easting major grid interval 1250m.

For the mineralized domains and the host rocks, a dry bulk density value of 2.67g/cm3 was used for converting volumes into tonnages. This factor is the average value of samples collected by Azarga. A dry bulk density factor of 1.8g/cm3 was assumed for the moraine material.

All mineral Resources were classified as Inferred, based on the data spacing, geological, and grade continuity assumptions.

Qualified Person

The Company’s President and Chief Executive Officer, Dorian L. (Dusty) Nicol, B.Sc. Geo, MA Geo, a Qualified Person as defined by NI 43-101, has reviewed and approved the exploration information disclosures contained in this Press Release.

About Azarga Metals Corp.

Azarga Metals is a mineral exploration and development company that owns 100% of the Unkur Copper-Silver Project in the Zabaikalsky province in eastern Russia.

On 23 March 2018, the Company issued the remaining 5,250,000 Consideration Shares (see NR 19 March 2018) having received TSX Venture Exchange clearance of a personal information form for one of the vendors who now owns more than 10% of the outstanding shares of Azarga Metals and has become a reporting insider.

AZARGA METALS CORP.

"Dusty Nicol"

Dorian L. (Dusty) Nicol, President and CEO

For further information please contact: Doris Meyer, at +1 604 536-2711 ext 6, or visit www.azargametals.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement:

This news release contains forward-looking statements that are based on the Corporation's current expectations and estimates. Forward-looking statements are frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate", "suggest", "indicate" and other similar words or statements that certain events or conditions "may" or "will" occur. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward-looking statements. Such factors include, among others: the actual results of current planned exploration activities; conclusions of economic evaluations; changes in project parameters as plans to continue to be refined; possible variations in ore grade or recovery rates; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing; and fluctuations in metal prices. There may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Corporation disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.